What if your investment portfolio could include assets that operate independently from traditional market cycles? This question drives growing interest in specialized investment vehicles designed for long-term projects.

The market for these vehicles has expanded significantly. Over the past decade, unlisted investment pools have raised more than $550 billion. This growth reflects the asset class’s unique characteristics, including decorrelation from GDP and public market performance.

These specialized arrangements organize capital for essential projects across diverse sectors. They span the entire risk-reward spectrum, offering various strategies and geographic exposures. Understanding how these frameworks function helps investors evaluate opportunities.

This guide explores the components of these investment vehicles. It examines how they differ from traditional options. The content covers investment frameworks, cash flow mechanisms, and regulatory considerations.

Key Takeaways

- Specialized investment vehicles have raised over $550 billion in the past decade

- These arrangements show decorrelation from traditional market performance

- They organize capital for long-term projects across diverse sectors

- Different strategies cater to various risk profiles and investor bases

- Understanding these frameworks helps align investments with goals

- They include unique cash flow mechanisms and regulatory considerations

- The landscape continues evolving with emerging trends and opportunities

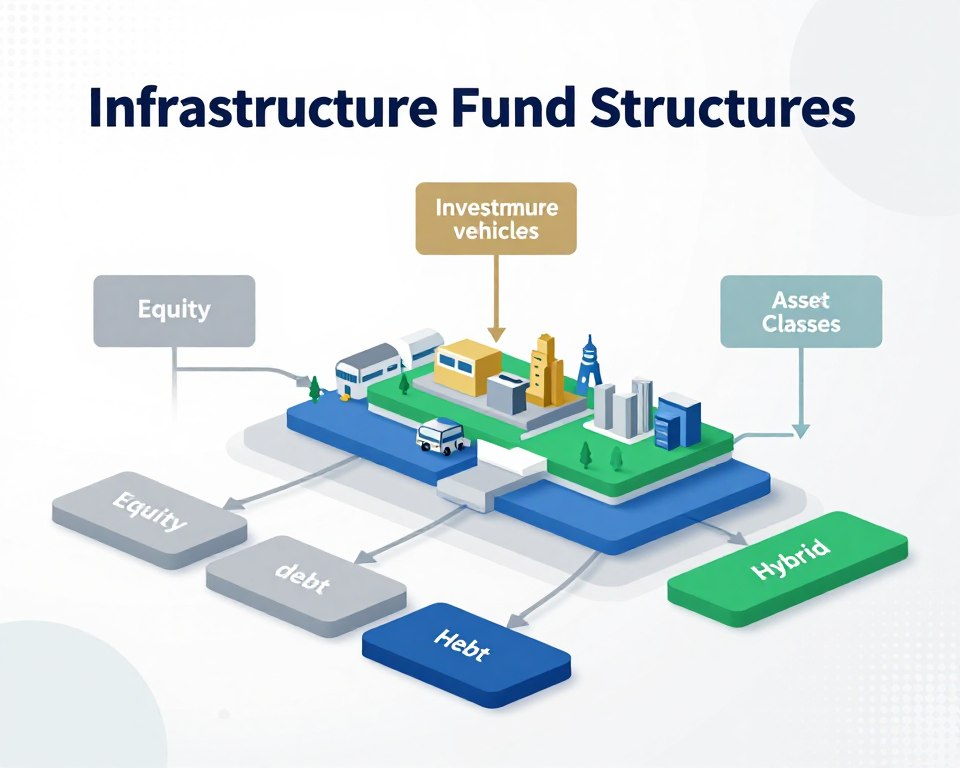

Overview of Infrastructure Fund Structures

Modern investment pools targeting essential public assets operate through carefully designed legal and financial constructs. These arrangements have grown significantly since the global financial crisis, with the private market more than tripling in size.

The diversity of this asset class spans multiple sectors, strategies, and geographic regions. Investment approaches range from lower-risk core strategies to higher-return opportunistic models.

Definition and Key Components

These specialized vehicles pool resources from multiple sources to acquire, develop, or manage essential assets. The organizational framework includes several critical elements:

- General partner manages operations and makes investment decisions

- Limited partners provide the majority of capital

- Clear investment strategy defining target sectors and risk profile

- Governance framework ensuring proper oversight and compliance

Target assets typically include utilities, transportation systems, communication networks, and energy facilities. Each component works together to create a cohesive investment system.

Context in the United States

The U.S. market operates under specific regulatory frameworks governing formation, disclosure, and investor protection. Increased investment activity responds to aging infrastructure needs and government support programs.

These organizational models must comply with securities laws, tax regulations, and industry-specific requirements. They provide mechanisms for capital deployment and risk management over extended periods.

Investment Frameworks and Cash Flow Mechanisms

Investment vehicles targeting essential assets derive their value primarily from consistent revenue generation rather than speculative appreciation. These arrangements focus on predictable income streams from operational activities.

The financial frameworks prioritize long-term stability through contractual and regulatory safeguards. They create reliable distribution patterns for investors seeking regular income.

Sources of Income from Underlying Assets

Essential service assets generate cash flows through multiple revenue channels. These income sources demonstrate remarkable consistency across economic cycles.

Primary revenue streams include:

- User fees from transportation systems and utilities

- Regulated tariffs for energy and water services

- Long-term lease agreements for communication assets

- Government payments for public service contracts

These cash flows benefit from high barriers to entry and limited competition. The essential nature of services ensures consistent demand patterns.

Mechanisms for Stable Cash Flows

Several contractual structures enhance cash flow predictability. Inflation-linked pricing adjusts revenues to maintain real returns.

Take-or-pay contracts guarantee minimum payments regardless of usage. Availability payments reward asset readiness rather than utilization rates.

Regulated return structures provide predetermined margins on capital investments. These mechanisms create stable cash flows relatively immune to economic fluctuations.

Lower-risk strategies focus exclusively on income from underlying assets. This approach appeals to investors prioritizing distribution consistency over capital growth.

Private Equity and Its Role in Infrastructure Investments

The intersection of private capital and essential public services creates unique investment opportunities with distinct characteristics. Private equity firms have expanded their activities significantly in this space over the past decade.

These specialized firms raise dedicated private equity funds targeting essential assets across various risk-return profiles. Their involvement brings operational expertise and capital access to critical systems.

Countercyclical Benefits

Essential assets demonstrate decorrelation from GDP performance and public market movements. This provides countercyclical benefits during economic downturns.

Strong inflation linkage protects returns through contractual escalators. Government support programs, including the Inflation Reduction Act, have increased opportunities for private equity involvement.

Market Resilience and Demand

The essential nature of these services maintains consistent demand even during recessions. People continue using utilities, roads, and communication systems regardless of economic conditions.

Market demand persists among institutional investors seeking stable returns with inflation protection. This resilience makes infrastructure assets attractive to private equity funds focused on long-term value creation.

Diversified Asset Strategies in Infrastructure Funds

The composition of infrastructure investment vehicles has transformed significantly over the past fifteen years. While core strategies once dominated the landscape, today’s market offers a wider spectrum of approaches.

This evolution provides options for various investor goals and risk appetites.

Core, Core-Plus, and Value-Add Approaches

Investment pools categorize their methods based on target risk and return. These categories help investors align capital with their specific objectives.

Core strategies focus on mature, operational assets. These investments generate stable cash flows from essential services like utilities and regulated transportation systems. They typically involve lower risk.

Core-plus approaches target similar assets but accept slightly higher risk. This may involve limited development projects or operational improvements to boost returns.

Value-add strategies seek assets needing enhancements. Active management and capital investment aim to improve performance and increase value. This involves a moderate risk level.

The market now includes more specialized vehicles. Debt-focused pools represent 13% of assets under management. Value-add strategies account for 22%.

- Opportunistic strategies target development projects or turnarounds.

- Distressed strategies focus on acquiring troubled assets.

- Specialization occurs by region, sector, or asset type.

ESG Considerations in Infrastructure Investments

Environmental, social, and governance criteria now shape capital allocation decisions for essential public assets. These factors help investors identify both risks and opportunities in long-term projects.

Large-scale projects naturally create significant environmental footprints. This makes thorough ESG assessment particularly important for responsible capital deployment.

ESG Risk Factors and Disclosure

Investment managers must evaluate multiple ESG risk categories. These include environmental hazards, community impacts, and governance practices.

Clear disclosure helps investors understand how ESG factors influence portfolio selection. Regulatory requirements increasingly demand transparency about ESG integration.

| ESG Factor Type | Common Risks | Potential Opportunities | Disclosure Focus Areas |

|---|---|---|---|

| Environmental | Pollution, climate risks | Renewable energy projects | Carbon footprint, resource use |

| Social | Community opposition | Job creation, access improvement | Stakeholder engagement |

| Governance | Regulatory compliance | Efficient operations | Board structure, ethics policies |

Impact on Investment Decisions

ESG considerations affect both opportunity identification and risk management. Many pools now focus on energy transition investments.

These factors can influence asset values, operating costs, and regulatory approvals. Proper ESG integration supports long-term performance stability.

Thorough assessment helps align capital with sustainable development goals while managing potential liabilities.

Comparing Closed-Ended and Open-Ended Fund Structures

Capital deployment models for extended-horizon investments vary significantly in their time horizons and investor access provisions. These organizational choices reflect the underlying investment strategy and income characteristics.

Typical Holding Periods and Liquidity Options

Fixed-term arrangements typically span 15 years or longer. This extended duration suits strategies focused on asset improvement and eventual sale.

Permanent capital models operate without predetermined end dates. They work well for income-generating assets requiring long-term stewardship.

Liquidity provisions differ substantially between these approaches. Fixed-term vehicles provide exit opportunities primarily through asset sales at maturity.

Continuous capital models offer periodic redemption rights. This gives participants flexibility not available in closed arrangements.

| Feature | Closed-Ended Structure | Open-Ended Structure |

|---|---|---|

| Duration | Fixed term (typically 15+ years) | Indefinite operation |

| Liquidity | Exit at fund termination | Periodic redemption options |

| Strategy Fit | Value-add and opportunistic | Core and core-plus income |

| Capital Raises | Initial fundraising period | Continuous capital intake |

| Holding Period | Asset sale at maturity | Long-term asset retention |

The choice between these frameworks depends on investment objectives and time preferences. Each offers distinct advantages for different participant profiles and asset types.

Evaluating Risk Profiles and Investor Returns

Different investment approaches carry distinct risk profiles that align with specific investor goals. The potential for returns corresponds directly to the level of risk assumed in each strategy.

Core investments typically demonstrate lower risk characteristics. They benefit from stable cash flows and established operational histories. This creates predictable performance patterns.

Value-add and opportunistic strategies involve higher risk exposure. These approaches target capital gains through development projects or operational improvements. The potential for greater returns comes with increased uncertainty.

This asset class generally shows lower correlation with public equity markets. This non-correlation provides diversification benefits during market downturns. It helps reduce overall portfolio volatility.

Investor returns come from two primary sources. Income distributions occur throughout the holding period. Capital appreciation happens upon asset sale or refinancing.

Risk assessment considers multiple factors. These include operational efficiency, regulatory changes, and demand patterns. Competitive position and macroeconomic sensitivity also influence risk levels.

Historical data shows this asset class has delivered stable returns. The performance typically demonstrates lower volatility than many alternative investments. This makes it attractive for long-term portfolio construction.

Attracting High Net Worth and Retail Investors

High net worth and retail investors now have expanded access to investment opportunities in tangible public assets. The market for these vehicles has grown beyond traditional institutional capital sources.

Individual participants find these assets more understandable than complex financial strategies. They involve familiar, essential systems people encounter daily.

Accessibility and Clarity of Real Assets

Real assets like utilities, toll roads, and communication towers have clear value propositions. This tangible nature resonates strongly with individual investors new to private markets.

Core and core-plus strategies with open-ended structures suit these investors well. They offer periodic redemption rights that provide liquidity options.

The combination of stable returns, inflation protection, and familiar assets creates compelling appeal. More than 15 new open-ended vehicles launched in 2022 alone.

Key advantages for individual investors include:

- Lower minimum investments compared to institutional requirements

- Simplified organizational frameworks with enhanced transparency

- Regular income distributions from essential service revenues

- Inflation-linked returns that protect purchasing power

This expansion reflects recognition that essential asset characteristics align well with individual investor preferences. The universe now exceeds 40 funds targeting broader capital bases.

The Growing Market for Infrastructure Secondaries

The secondary market for long-term capital projects provides investors with valuable flexibility. This segment allows participants to trade existing positions before official fund termination dates.

Transaction volume demonstrates significant growth. In the first half of 2023, deals reached between $2 billion and $4 billion. Many additional transactions targeted completion later that year or in early 2024.

Trends in LP-Led Transactions

Limited partners frequently initiate these sales. Approximately 61% of secondary deals were LP-led during this period.

These transactions address various investor needs. They provide liquidity, enable portfolio adjustments, or allow gain realization without waiting for fund maturity.

Pricing and Liquidity Aspects

Pricing remains relatively strong compared to other private market strategies. The cash-generating nature of underlying assets supports this stability.

This resilience appears even during broader market dislocations. The essential services continue producing reliable revenue.

| Transaction Type | Primary Motivation | Typical Pricing | Market Share |

|---|---|---|---|

| LP-Led Sales | Liquidity needs, portfolio rebalancing | Strong relative to NAV | Approximately 61% |

| GP-Led Restructurings | Fund life extension, asset repositioning | Varies by asset quality | Approximately 39% |

| Direct Asset Sales | Strategic exits, capital recycling | Based on cash flow projections | Small but growing segment |

Long terms for closed-end vehicles create ongoing demand. Investor circumstances change over extended periods. This natural evolution drives continued deal volume.

Most major secondary managers now operate dedicated strategies. They capture this growing transaction flow in the infrastructure space.

Unique Fund Terms and Redemption Rights

Organizational documents for long-term asset ownership contain unique clauses addressing extended time horizons and investor liquidity needs. These specialized provisions reflect the distinctive characteristics of essential service investments.

The legal frameworks governing these investment vehicles share similarities with private equity funds but include important distinctions. Core strategies typically feature lower fee structures and extended durations.

Fund Economics and Holding Periods

Management fees and performance allocations often correlate with risk profiles. Lower-risk approaches may have reduced carried interest rates compared to opportunistic strategies.

Investment periods frequently span 15 to 20 years or longer. This extended timeframe aligns with the long-term nature of essential asset ownership and operation.

Many core and core-plus vehicles include periodic redemption rights. These provisions allow limited partners to exit before final termination dates. Redemption opportunities typically occur quarterly or annually with reasonable limitations.

Governing documents often permit affiliated service providers to offer specialized support. These arrangements require transparent disclosure and proper conflict management procedures.

Some frameworks contemplate alternative liquidity mechanisms. These may include public listings or mergers with existing publicly traded entities. The economics balance stable income generation with potential capital appreciation.

Finance Tools and Credit Facilities in Fund Structures

Borrowing arrangements provide flexible financing options throughout different stages of the investment lifecycle. These credit tools help managers optimize timing and manage liquidity effectively.

Specialized facilities address distinct needs during capital deployment cycles. They bridge timing gaps between commitments and actual investment requirements.

Subscription Credit Facilities and NAV Lines

Subscription credit facilities use unfunded investor commitments as collateral. These tools allow managers to make investments before formal capital calls.

Key benefits include:

- Execution certainty for timely deal completion

- Consolidated capital calls reducing administrative burden

- Access to letters of credit for various requirements

NAV-based facilities secure credit against portfolio values rather than uncalled capital. They typically activate after most commitments are invested.

Collateral includes equity interests and rights to investment proceeds. These facilities maintain liquidity during later investment stages.

Hybrid Credit Options

Hybrid facilities combine features from both subscription and NAV models. They offer flexible borrowing capacity across the entire fund lifecycle.

These arrangements use mixed collateral packages. They cover both capital commitments and portfolio investment values.

Managers must coordinate these tools with investor communications and legal provisions. Proper structuring ensures smooth operations throughout the investment period.

Legal Insights and Regulatory Compliance for Fund Structures

Legal frameworks governing capital deployment for essential assets require careful attention to regulatory obligations and disclosure standards. These frameworks ensure proper governance and protect investor interests throughout the investment lifecycle.

Compliance begins during formation with entity selection and registration determinations. Proper documentation prepares the vehicle for successful capital raising and operation.

Disclosure Requirements and Affiliated Service Providers

Clear communication about strategies, risks, and fees builds investor confidence. Disclosure must address environmental, social, and governance factors influencing decisions.

Many arrangements include flexibility for general partner affiliates to provide specialized services. These may include design, development, or asset management support.

Affiliated service arrangements require specific disclosure about potential conflicts. Proper oversight mechanisms ensure these relationships benefit all participants.

Ongoing compliance includes periodic reporting and valuation procedures. Managers must coordinate requirements across different jurisdictions when operating internationally.

Thorough documentation helps during investment return audits. Legal structures should accommodate diverse investor types including tax-exempt organizations.

Infrastructure Fund Structures in Private Markets

The landscape of private capital allocation reveals distinct positioning for investments in essential public services. These arrangements have demonstrated significant growth since the global financial crisis.

Comparison Across Asset Classes

Essential service investments represent a separate category within private markets. They exist alongside private equity, private credit, and real estate. This asset class shows unique characteristics compared to traditional private equity.

The market for these investments has more than tripled in size. Over $550 billion has been raised in the past decade. Institutional investors increasingly allocate capital to this category.

Key differentiators include longer asset lives and stable cash flows. Essential service characteristics provide inherent advantages. These features create lower volatility than traditional private equity.

| Asset Class | Primary Focus | Risk Profile | Typical Returns |

|---|---|---|---|

| Private Infrastructure | Essential public services | Lower volatility | Stable income + inflation protection |

| Traditional Private Equity | Company ownership & growth | Higher volatility | Capital appreciation focused |

| Private Credit | Debt financing | Moderate risk | Fixed income streams |

| Real Estate | Property ownership | Market cyclical | Rental income + appreciation |

Equity funds targeting essential services span the complete risk spectrum. Strategies range from core assets to opportunistic investments. This diversity allows institutional investors to match their specific objectives.

The asset class continues expanding as investment opportunities grow. Its position in private markets strengthens with increasing recognition of distinct benefits.

Conclusion

The organizational models for capital allocation in public infrastructure have progressed significantly. They provide clearer pathways for investor participation across different risk profiles.

These investment vehicles offer diverse approaches for accessing long-term opportunities. Core strategies emphasize stable income, while value-add approaches target capital appreciation. Investors can select options that match their specific objectives.

The essential nature of these assets supports continued market expansion. Energy transition trends and aging public systems create ongoing investment potential. Understanding these frameworks helps participants make informed decisions across asset classes.

This guide explores the foundational elements of infrastructure fund structures. It examines how different arrangements serve various investor needs in private markets.