- Read More: Tail Risk Explained: A Comprehensive Investment Guide

What if your biggest financial threat is an event you’ve never even considered? Standard investment…

- Read More: Institutional Asset Allocation Explained

What if the most important decision for a multi-billion dollar pension fund is the same…

- Read More: Downside Risk Explained: How to Assess and Manage

What if your main job as an investor isn’t to pick winners, but to avoid…

- Read More: Loss Aversion Bias Explained

Research suggests people feel the pain of a financial setback about twice as intensely as…

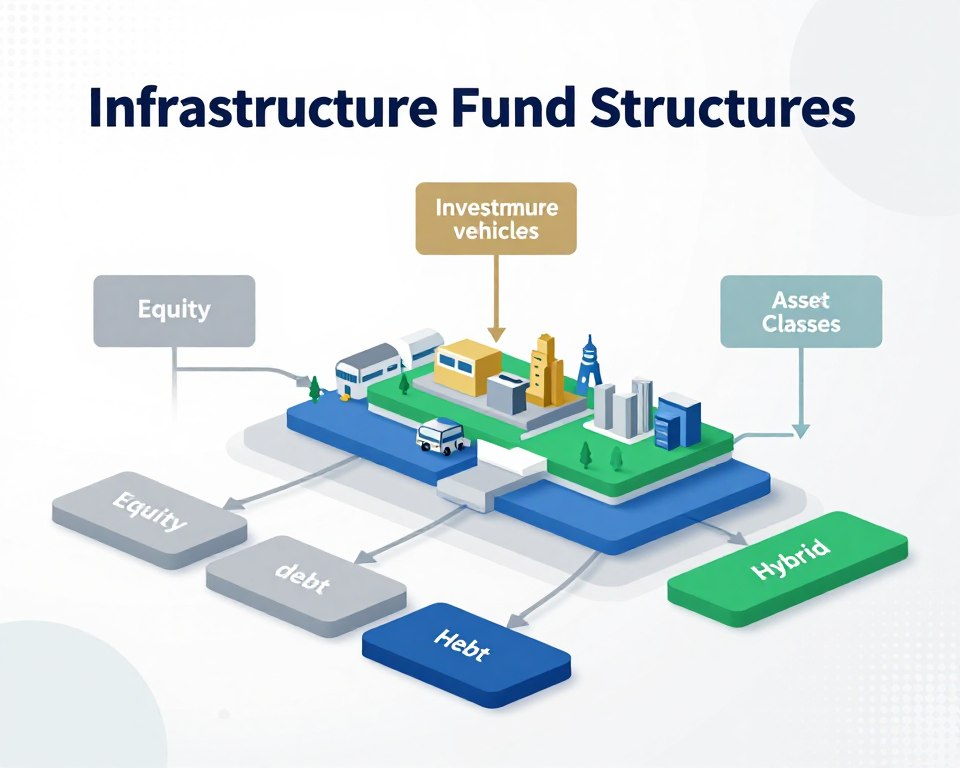

- Read More: Infrastructure Fund Structures Explained

What if your investment portfolio could include assets that operate independently from traditional market cycles?…

- Read More: How Public Pension Funds Invest

Have you ever wondered who manages the retirement money for teachers, firefighters, and police officers…

- Read More: Risk Tolerance vs Risk Capacity

Nearly half of all investors admit they don’t fully understand the key financial terms that…

- Read More: Counterparty Risk Explained: A Beginner’s Guide

What if every financial handshake you make carries a hidden uncertainty? This question lies at…

- Read More: Delayed Gratification in Investing

The average American picks up their phone more than 50 times a day. This constant…

- Read More: How Pension Funds Invest in Infrastructure

What if the roads you drive on and the power that lights your home were…

- Read More: Short-Term Bias in Investing

A staggering 95% of day traders lose money over time. This figure often stems from…

- Read More: Execution Risk Explained: Causes and Consequences

Have you ever wondered why a brilliant business idea, backed by a solid strategy, still…

- Read More: How Sovereign Wealth Funds Invest

What if a country itself could be one of the world’s largest and most powerful…

- Read More: Construction Risk in Investing: Key Considerations

What if the biggest danger to your capital wasn’t a market crash, but the very…

- Read More: Why Patience Matters in Investing

Warren Buffett famously stated that the stock market is a device for transferring money from…

- Read More: Closed-End Infrastructure Funds

What if you could invest in the essential systems that power our daily lives, but…

- Read More: The Ultimate Guide to Liquidity Risk Explained

What if a business, seemingly strong on paper, suddenly couldn’t pay its bills? This scenario…

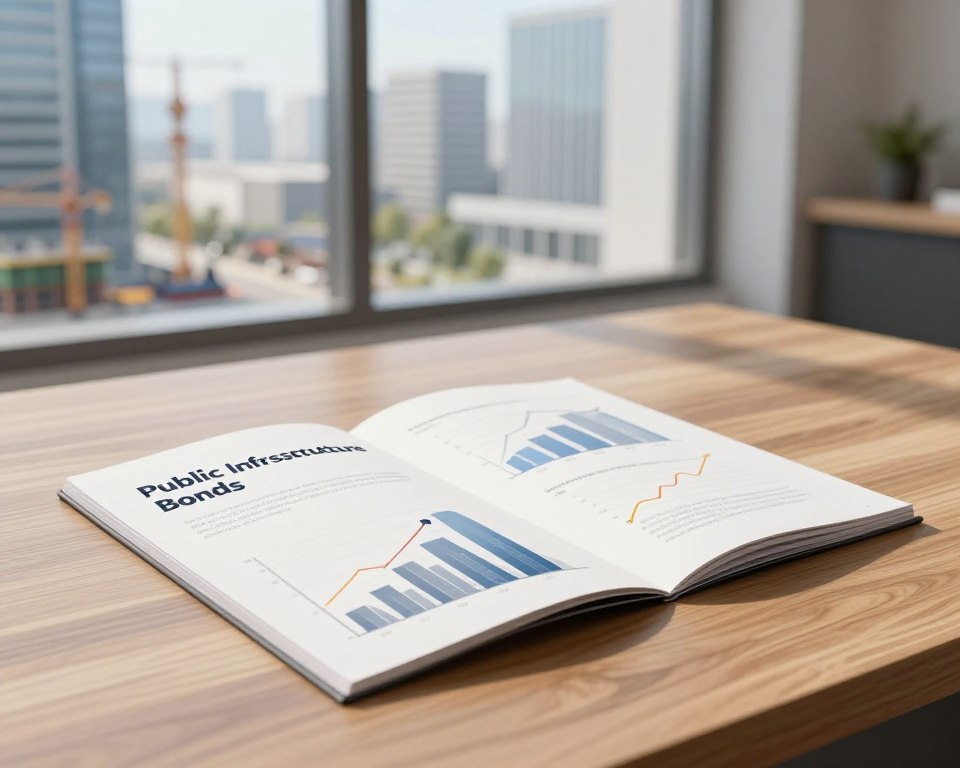

- Read More: Public Infrastructure Bonds Explained

What if you could invest in the roads you drive on or the power grid…

- Read More: Regulatory Risks in Infrastructure Investing

What if the biggest hurdle to building our future isn’t a lack of money, but…

- Read More: Time Horizon Bias in Investing

In the 1960s, the average stock was held for eight years. Today, that period has…