In the world of risk management, the debate between passive and active strategies is a hot topic that often stirs up strong opinions among professionals. Navigating through these […]

Strategies for Risk Management in International Portfolios

Diving into the world of international investing can be as thrilling as it is complex. With high stakes comes the need for solid risk management strategies. Whether you’re […]

ESG Factors in Risk Management Strategies

In today’s business landscape, navigating the complexities of risk management requires a keen eye on ESG factors—environmental, social, and governance. These elements are more than just buzzwords; they’re […]

What Is Currency Risk in International Investing?

Currency threat, in any other case generally known as trade charge threat, arises from the change in worth of 1 forex relative to a different. Investors participating in […]

Risk Management in ETFs vs Mutual Funds

Navigating the waters of investment can be as thrilling as it is daunting, especially when weighing the risk management aspects of Exchange-Traded Funds (ETFs) and Mutual Funds. Both […]

What Are the Most Common Risk Management Techniques?

Risk management is the procedure of recognizing, examining, and managing risks to a company’s capital and incomes. These risks, or dangers, might come from a wide range of […]

How Does Insurance Fit into an Investment Strategy?

Insurance, typically viewed exclusively as a safeguard for unexpected disasters, can really function as a critical part in a well-rounded investment method. Fundamentally, insurance offers monetary security versus […]

Who Bears All The Investment Risk In A Fixed Annuity

A fixed annuity is a kind of insurance coverage agreement which assures to pay the holder a surefire earnings at routine periods, usually after retirement. This type of […]

Which Risk Management Principle Is Best Demonstrated By Applying

In the complex world of risk management, one principle typically stands apart for its capability to incorporate a broad series of applications: the preventive principle. At its core, […]

What Is Tactical Asset Allocation?

In the vibrant landscape of financial investment management, Tactical Asset Allocation (TAA) stands apart as a technique that actively changes financial investment positions to take advantage of market […]

How To Protect Your Assets From Risk Management Through Insurance

In the landscape of monetary wellness, possession security stands as an important bastion versus the unpredictability of life’s many dangers. Fundamentally, possession security is the execution of tactical […]

When Should Project Managers Engage In Risk Management

Risk management is an important part of a project supervisor’s tasks, working as the compass to browse through the unpredictabilities fundamental in any project. By meaning, risk management […]

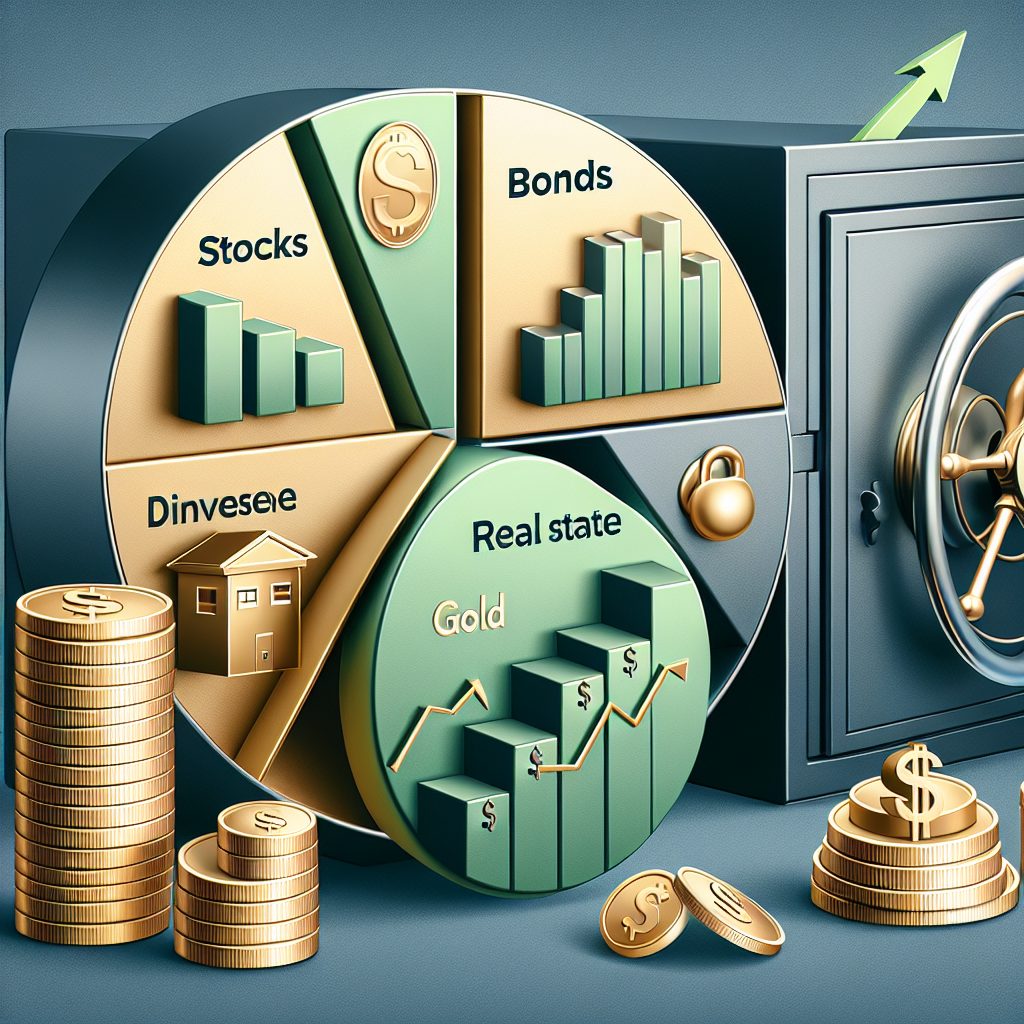

What are the benefits of diversification in an investment portfolio?

In the world of investing, diversification belongs to not putting all your eggs in one basket; it’s the technique of dispersing financial investments throughout different monetary instruments, markets, […]

Building a Portfolio with Risk Management in Mind

Crafting a robust investment portfolio isn’t just about picking winners; it’s about smart risk management. It’s the art of balancing potential gains with the right amount of safety […]

Financial Derivatives: Tools for Risk Management

Navigating the turbulent waters of financial markets requires more than just intuition; it demands robust tools that can shield investments from unexpected storms. Financial derivatives stand out as […]

Liquidity: An Often Overlooked Aspect of Risk Management

In the intricate world of financial management, liquidity tends to slip under the radar, yet it’s the lifeblood that keeps businesses afloat in choppy markets. It’s a critical […]

What are the best ways to manage investment risk?

Investment threat is the capacity for monetary loss intrinsic in any investment choice. Pivotal to comprehending this principle is the awareness that the nature of investment is fundamentally […]

Retirement Planning: Incorporating Risk Management

Stepping into retirement is like setting sail on a voyage where the waters can unpredictably turn rough. It’s a journey that demands not just a map, but also […]

Drafting a Comprehensive Risk Management Plan

Navigating the unpredictable waters of business risk is an essential skill for any organization. Crafting a comprehensive risk management plan isn’t just about ticking off boxes; it’s about […]

Real Estate Investing: A Risk Management Perspective

Diving into the world of real estate investment, it’s clear that the terrain is fraught with potential pitfalls and windfalls alike. It’s a game where the stakes are […]