Tax Implications of Investing

- Read More: Claiming Tax Deductions for Investment-Related Expenses

Navigating the labyrinth of tax deductions can be as challenging as mastering a game of…

- Read More: Tax Rules for Investing in Gold and Precious Metals

Navigating the tax implications of gold and precious metal investments can feel like a maze.…

- Read More: Strategies to Reduce Your Investment Tax Liability

Navigating the labyrinth of investment taxes can feel like an uphill battle. Yet, there’s good…

- Read More: Navigating State Tax Considerations for Your Investments

Investing is more than just picking the right stocks and bonds; it’s also about smart…

- Read More: Tax Implications for Investments in Mutual Funds and ETFs

Navigating the tax landscape of mutual fund and ETF investments can be as winding as…

- Read More: Effective Year-End Tax Planning Strategies for Investors

As the year winds down, savvy investors gear up for a crucial task: fine-tuning their…

- Read More: How Inflation Affects the Taxation of Investment Returns

Inflation isn’t just about higher prices at the checkout line; it also chips away at…

- Read More: IRS Reporting for Investors: What You Need to Know

Navigating the complexities of IRS reporting can be a daunting task for investors. Whether you’re…

- Read More: Understanding Tax Implications for Investments in Peer-to-Peer Lending

Peer-to-peer lending has become a go-to for many investors seeking alternative avenues to traditional banks.…

- Read More: Tax Considerations for Alternative Investments

Navigating the maze of tax implications for alternative investments can be as complex as the…

- Read More: Tax Treatment of Income from Bonds and Other Fixed-Income Investments

Navigating the tax implications of income from bonds and other fixed-income investments can feel like…

- Read More: Tax Strategies and Implications for Gifting Investments

Navigating the labyrinth of tax regulations can be daunting, especially when considering the transfer of…

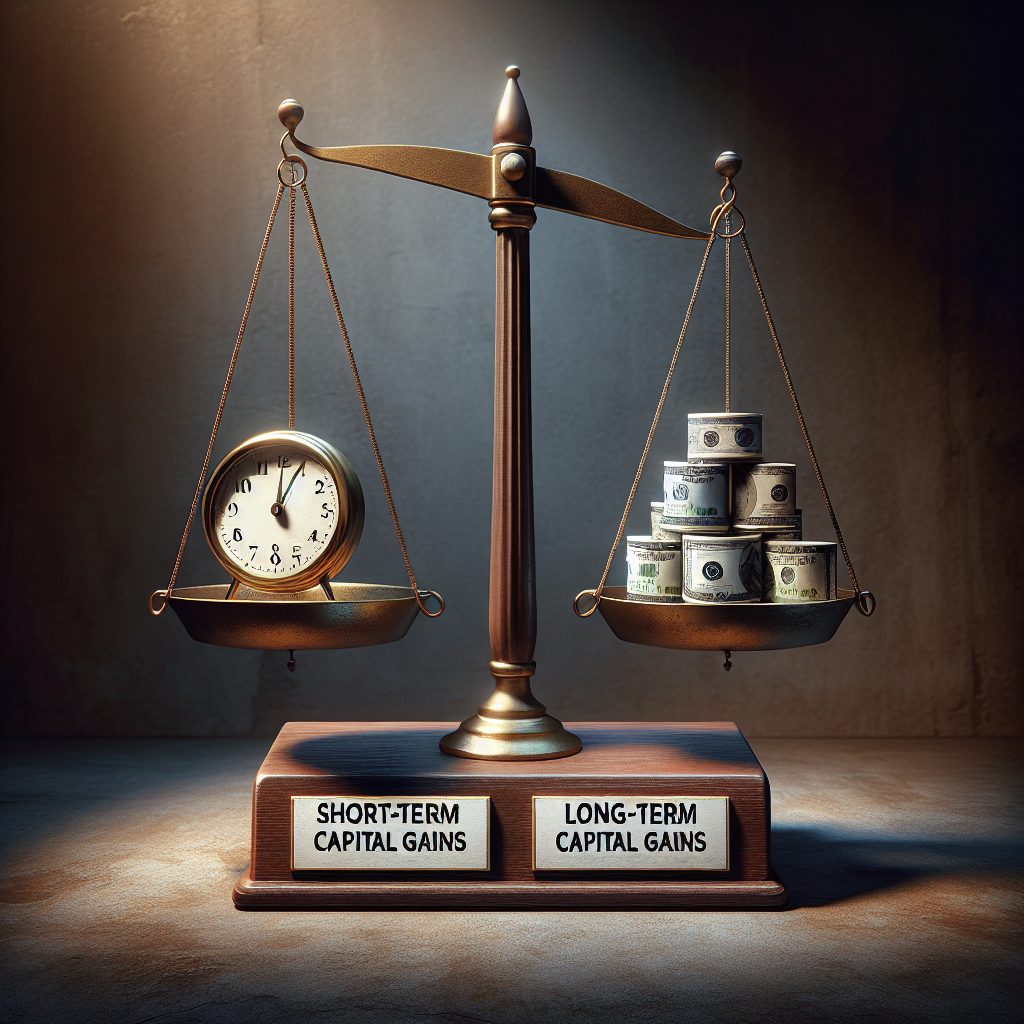

- Read More: Comparing Short-Term and Long-Term Capital Gains Tax Rates

As you dive into the world of investments, the terms ‘short-term’ and ‘long-term capital gains…

- Read More: Navigating the Tax Implications of Stock Splits and Corporate Mergers

When a company announces a stock split or merges, it’s not just Wall Street that…

- Read More: The Benefits of Investing Through Tax-Deferred Accounts

Navigating the world of investments can feel like steering a ship through foggy waters. But…

- Read More: Leveraging Tax Credits in Renewable Energy Investments

As the sun rises on a greener economy, savvy investors are turning their gaze toward…

- Read More: Understanding the Tax Implications of Cryptocurrency Investing

Navigating the intricate maze of cryptocurrency taxation can feel like a trek through uncharted territory.…

- Read More: Tax Considerations for International Investments

Venturing beyond borders to invest can be as thrilling as it is complex. Tax implications…

- Read More: Incorporating Tax Strategy into Estate Planning and Investments

Navigating the complexities of financial growth involves more than savvy investments; it’s also about smart…

- Read More: Choosing Tax-Efficient Mutual Funds for Your Portfolio

Investing in mutual funds can be a savvy move for your financial growth, but it’s…