Have you ever wondered who manages the retirement money for teachers, firefighters, and police officers across the nation?

These retirement systems represent a cornerstone of financial security for public sector employees. They manage a colossal amount of capital, with combined assets exceeding $6.0 trillion in the United States. This financial engine supports over 5,000 distinct plans.

These systems serve a vast community. They support 15.3 million active members and 12.4 million retirees. Every year, they distribute more than $405.5 billion in benefits. This flow of payments relies on careful and strategic management of contributions.

The primary goal is to grow these assets over the long term. This growth ensures promised benefits can be paid for decades to come. The approach differs significantly from individual retirement accounts. It involves a defined benefit structure and a very long investment horizon.

Understanding this process sheds light on how retirement security is maintained for millions. It involves complex strategies to generate sufficient returns. This section provides a foundational overview of this critical financial activity.

Key Takeaways

- Public sector retirement systems manage trillions of dollars in assets for millions of workers and retirees.

- These systems provide a vital stream of income, distributing hundreds of billions in benefits annually.

- The core function is to invest contributions during working years to fund retirement income later.

- This approach is defined by a long-term horizon and a promise of specific future benefits.

- Effective management is crucial for fulfilling promises to public servants like teachers and first responders.

- The scale of these operations highlights their importance to the national financial landscape.

Overview of Public Pension Funds

Government employee retirement programs function through a collaborative contribution system between workers and employers. This framework supports millions of state and local workers across the United States.

Definition and Structure

A pension plan operates as a defined benefit retirement system. Workers and employers both contribute during employment years. These contributions get invested to generate growth.

Retirees receive a guaranteed monthly income for life. The structure relies on three funding sources. Employee payments, employer contributions, and investment returns work together.

Historical Background

The first public pension plan started in 1857 for New York City police officers. American Express created the initial private plan in 1875. Public systems have operated for over 150 years.

These retirement plans developed independently across thousands of jurisdictions. State-administered and locally-run systems evolved separately. Public plans remained strong while private sector options declined.

Today, nearly $6 trillion in assets support 34 million public servants. About 5,000 distinct systems exist nationwide. Many government workers rely entirely on these plans since they lack Social Security coverage.

Understanding how pension plans vs 401k differ helps clarify their unique role. The defined benefit structure provides predictable retirement income for essential workers.

Historical Investment Strategies and Returns

Historical approaches to managing retirement assets reveal a dynamic pattern of adaptation to economic cycles and market opportunities. These systems have navigated various periods with distinct investment philosophies.

Traditional Asset Classes

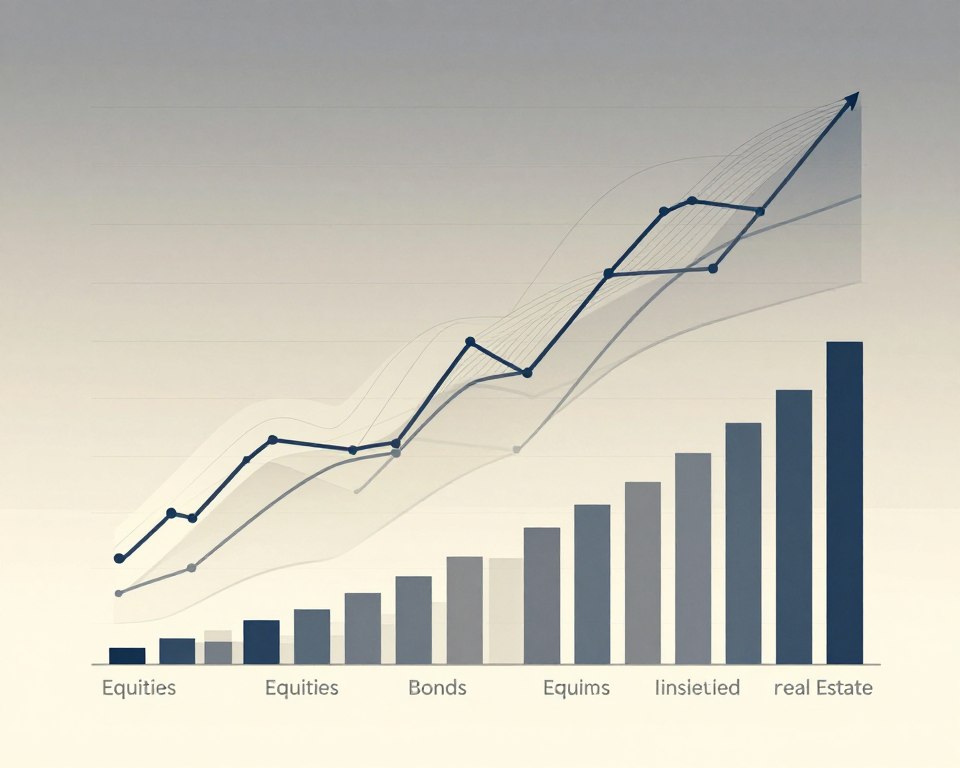

Initially, portfolios concentrated heavily on conventional assets. The year 2001 showed a typical allocation of 58.2% to equities and 31.0% to fixed income securities.

This traditional mix delivered strong performance during the 1990s bull market. Global equity markets generated exceptional returns that boosted funding levels above 100%.

Shift to Alternative Investments

Market downturns in 2000-2002 and 2008-2009 prompted strategic reassessment. These events demonstrated the vulnerability of traditional-only approaches.

Systems progressively increased allocations to alternative assets over two decades. Alternative investments grew from 14% of risky holdings in 2001 to 39% by 2021.

For every dollar removed from fixed income, $2.60 flowed into alternatives. This shift represented a fundamental change in investment philosophy seeking enhanced returns.

Public Pension Fund Investing Trends

Contemporary portfolio management approaches show a marked departure from traditional investment philosophies. Retirement systems increasingly favor alternative assets over conventional stocks and bonds.

Growth in Private Equity and Debt

Major retirement systems now commit billions to private markets. In March 2024, CalPERS endorsed a strategy to increase private market investments by over $30 billion.

The system manages more than $500 billion in retirement assets. CalPERS acknowledged that avoiding private equity potentially caused it to miss out on $18 billion in returns over the previous decade.

Data from Recent Studies

A Stanford Graduate School of Business study revealed key insights. Pension managers believe alternative investments can yield superior returns compared to traditional options.

Investment consultants’ beliefs about potential relative returns from alternatives increased by approximately 68 basis points since 2001. This “consultant effect” accounts for the entire increase in alternative investment allocations.

Impact on Long-Term Returns

Private equity delivered strong performance at many large retirement systems. At CalPERS, it was the best-performing asset class in the decade before 2023.

The asset class generated annual returns of nearly 12%. This compared favorably to 8.9% from public equities and 2.4% from fixed income. The shift toward alternatives reflects a search for enhanced long-term performance.

Asset Allocation and Risk Management

The careful distribution of capital across various investment types defines modern portfolio strategy. This process balances the need for growth with the imperative of safety.

Current strategies show a diverse mix. Equities make up 42.3% of typical holdings. Fixed income accounts for 21.1%.

Alternative assets now play a major role. Private equity represents 13.8%. Real estate holdings are at 9.1%. Hedge funds comprise 6.5% of the total portfolio.

Portfolio Diversification

Spreading investments reduces concentration risk. This approach protects against downturns in any single market.

Asset allocation has transformed over two decades. In 2001, portfolios held 58.2% equities and 31.0% fixed income. Alternatives were a minor part of the strategy.

Today’s allocations reflect a significant shift. The move aims to capture returns from a wider range of sources.

Risk and Return Considerations

Managers develop target allocations based on several factors. These include risk tolerance and projected benefit payments.

The long-term nature of these plans allows a focus on enduring results. Short-term market volatility is less concerning.

Research indicates the turn toward alternatives seeks superior performance. It is not primarily driven by a desire for greater risk.

Funding levels had a minimal impact on this strategic evolution. The goal remains generating earnings with an acceptable level of risk.

Challenges and Limitations in Pension Investing

Retirement programs face complex obstacles that require careful balancing of financial obligations and legal requirements. These systems must navigate substantial hurdles to maintain long-term viability.

Funding Gaps and Liabilities

Analysts identify a $5.1 trillion shortfall between promised benefits and available assets. This gap represents unfunded liabilities accumulated over decades.

Employer contribution requirements have increased significantly. Payments rose from 6.8% of payroll in 2001 to 21.8% in 2024.

Demographic changes create additional pressure. The ratio of active workers to retirees declined from 2.5 in 1992 to 1.2 today.

Regulatory Constraints

Retirement systems operate under the Employee Retirement Income Security Act of 1974. ERISA’s prudent investor rule requires diversification and maximum financial returns.

Some states prohibit social impact investments fearing reduced returns. This creates tension between financial goals and other policy objectives.

Operational challenges also exist. Staff often lack resources to manage complex portfolios effectively.

| Challenge Type | Key Metric | Timeframe Change | Impact Level |

|---|---|---|---|

| Funding Gap | $5.1 trillion liability | Multi-decade accumulation | High |

| Employer Contributions | 21.8% of payroll | 2001-2024 (+15%) | Medium-High |

| Demographic Pressure | 1.2 workers per retiree | 1992-2024 decline | High |

| Cash Flow | -2.1% of assets | Persistent negative | Medium |

These constraints affect the ability to maintain reliable retirement income for beneficiaries. Investment performance must overcome these structural challenges.

Conclusion

Investment approaches for state and local employee retirement systems have undergone profound changes to meet future benefit promises. These systems now allocate nearly 40% of their portfolios to alternative assets like private equity and real estate.

This strategic shift aims to enhance long-term performance. Private equity has delivered superior returns compared to traditional equities and bonds at major systems. The transformation reflects belief in alternative investment potential rather than desperate risk-taking.

Significant challenges persist, including a $5.1 trillion funding gap and demographic pressures. Regulatory constraints under ERISA also limit some investment options while staff resources remain constrained.

When managed effectively, these retirement plans generate substantial economic benefits. For every dollar paid to retirees, $2.13 in economic activity results. Examples from Fresno County and New York City demonstrate how strategic allocations can support community development while achieving solid returns.

Understanding these investment trends, asset allocations, and performance metrics is essential for evaluating the long-term sustainability of retirement security for government workers across the United States.