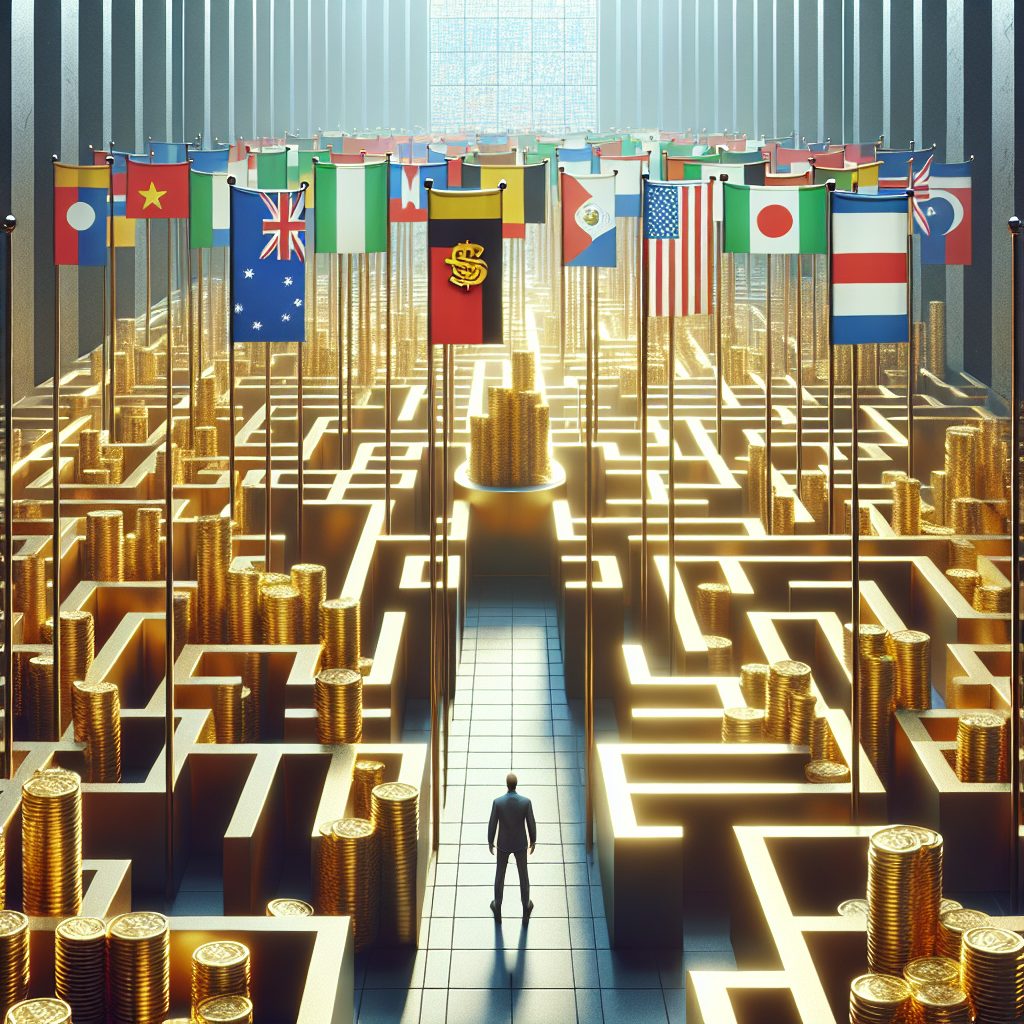

international markets

- Read More: Navigating the Repatriation of Profits from International Markets

When global businesses flourish, the challenge of moving earnings back home surfaces. Navigating the repatriation…

- Read More: What is a global mutual fund?

In the big world of financing, a global mutual fund stands as a varied portfolio…

- Read More: Why Should Investors Consider International Markets?

Diversification is a foundation idea in financial investment theory, promoting for spreading out threat throughout…